Babylon, a digital care company, has signed a definitive agreement to merge with Alkuri Global Acquisition in a deal worth about $4.2bn. The move will take the company public.

To support the transaction, Alkuri Global is raising a $230m private placement with 85% contributed by new investors such as AMF Pensionsförsäkring and Swedbank Robur.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe deal represents an equity value of nearly $4.2bn for Babylon, which will receive gross proceeds of up to $575m, including approximately $345m in cash from Alkuri Global’s trust account.

Founded in 2013, Babylon enables individuals to book a video chat with a doctor using its app. It can also be used to check symptoms or schedule an appointment with specialists, including therapists.

The digital platform focuses on virtual clinical operations to deliver personalised healthcare. Its portfolio includes Babylon 360 and Babylon Cloud Services.

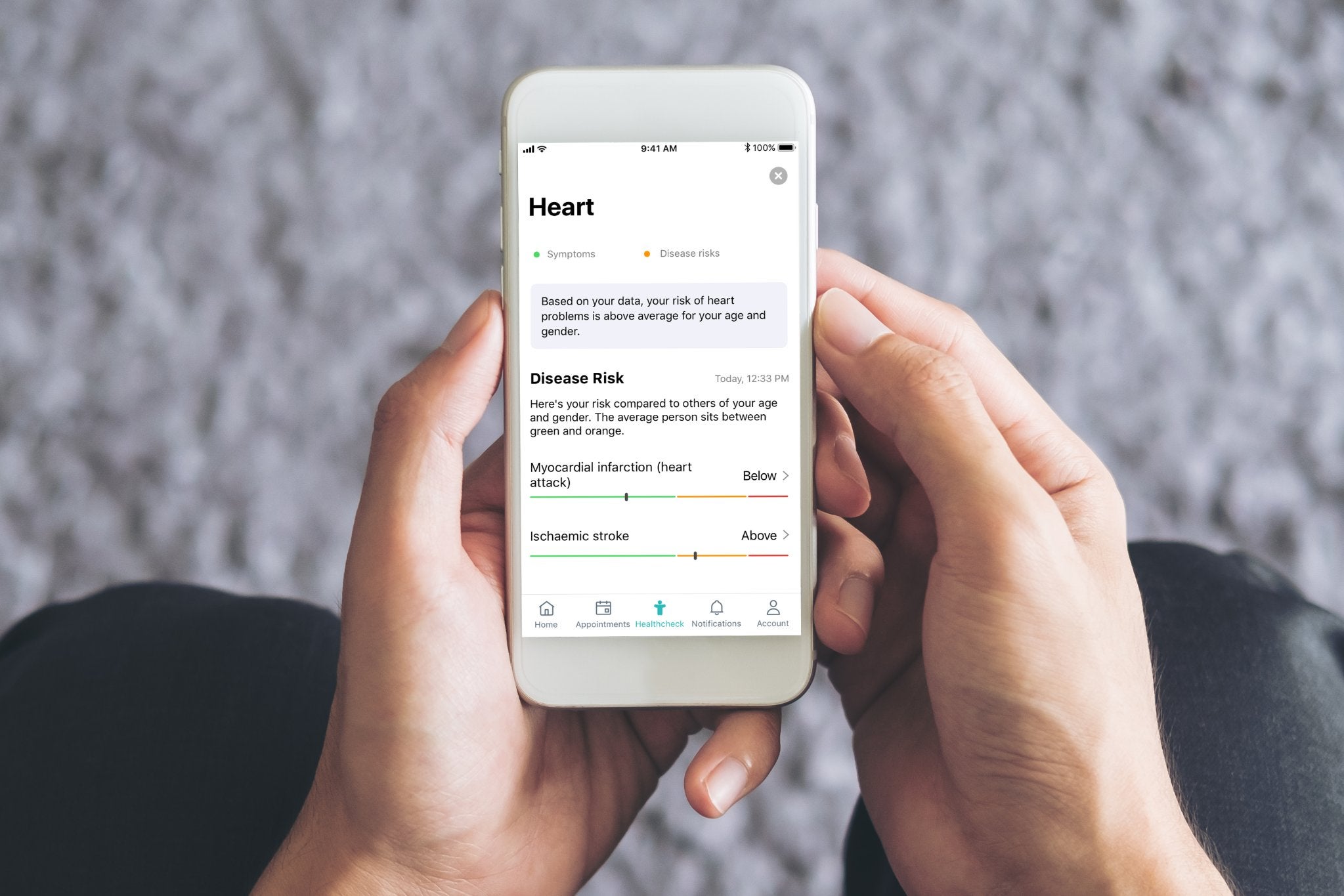

Driven by artificial intelligence, doctors’ expertise and the company’s data, Babylon 360 aims to prevent hospitalisations by providing users actionable insights and information on their health.

A survey found that 40% of Babylon 360 members’ consultations avoided the emergency room or urgent care visits.

A suite of digital tools for self-care, Babylon Cloud Services comes with an AI symptom checker that acts as a constant health information database for patients.

The suite also comprises Babylon Healthcheck for evaluation to spot at-risk conditions. It also suggests the next steps for members to improve overall health and lower future disease risk.

Babylon provides these services to people in the US, Canada, Europe and 13 Asian countries. Last year, the company recorded six million patient interactions, helping one patient every five seconds.

Babylon CEO and founder Dr Ali Parsa said: “We have achieved one of the highest growth rates every year since our inception, with consistently high clinical outcomes and patient satisfaction.

“Becoming a public company is just another step in our journey. We are at the very beginning of our work to re-imagine our sector, to make it digital-first and prevention-first and shift the focus away from sick care to true health care.”

The merger is set to complete in the second half of this year, following which the combined entity will run as Babylon.