US-based non-profit health system LCMC Health’s acquisition of East Jefferson General Hospital (EJGH) has been approved by Jefferson Parish voters.

The acquisition will continue to provide access to healthcare in Jefferson Parish and financial stability with $100m in investments.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIt will also safeguard jobs of around 3,000 health care workers.

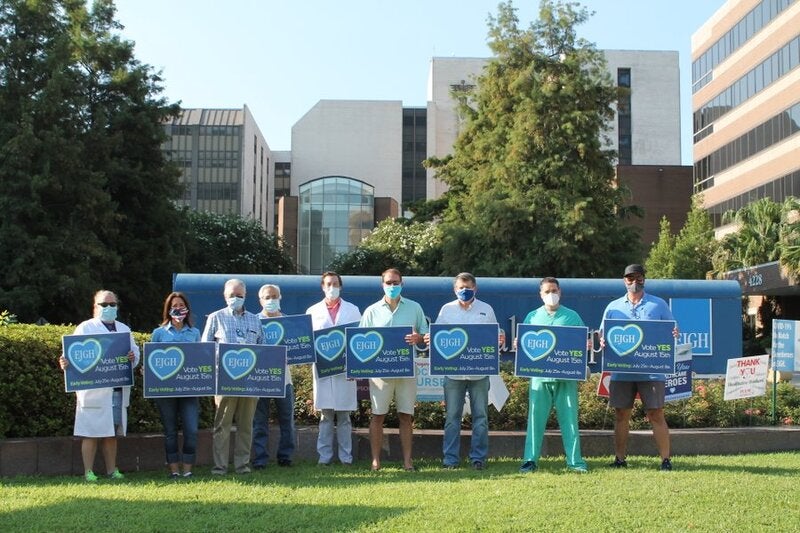

EJGH president and CEO Gerald Parton said: “The voters on the East Bank showed their support of our doctors and team members at EJGH today.

“Their decision paves the way for saving their hospital and putting it on a path to provide great healthcare to our community for decades to come.

“We needed the voters to make this happen and we thank them for standing with us.”

As of 15 August, the EJGH agreement generated 95% support among East Bank voters with more to follow.

The partnership will be finalised in the following weeks.

Currently, LCMC Health’s system includes Children’s Hospital New Orleans, New Orleans East Hospital, Touro, University Medical Center New Orleans and West Jefferson Medical Center.

Jefferson Parish president Cynthia Lee Sheng said: “Now more than ever, we need our local hospitals and I’m so glad that the residents of Jefferson Parish voted to approve the sale of EJGH to LCMC Health.

“This vote was very critical to the hospital’s future success. We all want EJGH to thrive because it is a very beloved institution for many of us in Jefferson Parish.

“It is very difficult financially to be a stand-alone hospital so now EJGH will be part of a larger system with LCMC Health and will have access to more resources, in addition to $100m in investments over the next five years.”